vermont income tax refund

B-2 Notice of Change. PA-1 Special Power of Attorney.

Filing Season Updates Department Of Taxes

Mon Tue Thu Fri 745 am-430 pm.

. If youre using the mobile app you may need to scroll down to find your refund amount. B-2 Notice of Change. If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the difference.

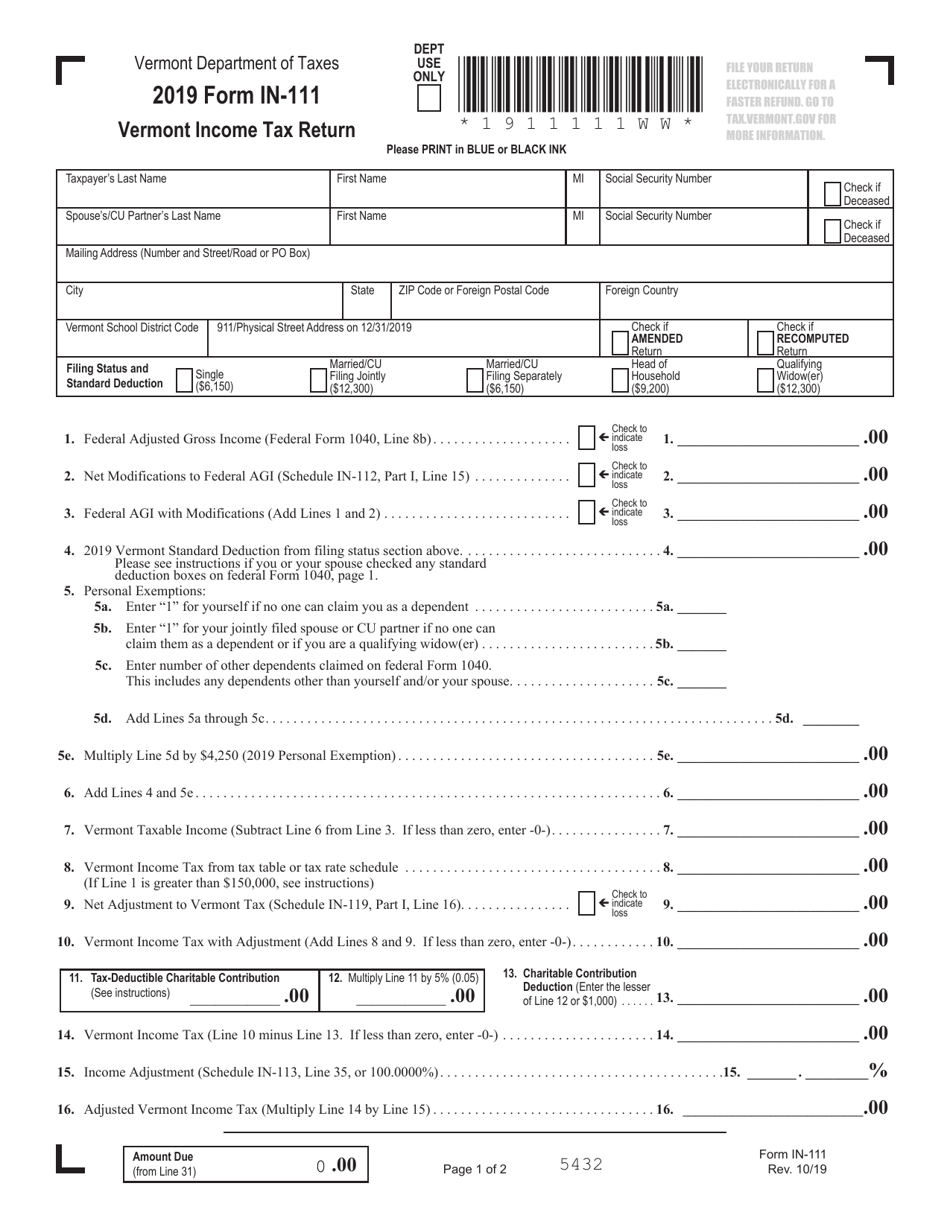

IN-111 Vermont Income Tax Return. You can also track your refund with. Vermont State Tax Filing Deadline Vermont income tax returns are due on April 15th.

Most capital gains in Vermont are subject to the personal income tax rates of 335 - 875. The basics of Vermont state tax Taxing body. All Forms and Instructions.

Tracking your Vermont tax refund. B-2 Notice of Change. IN-111 Vermont Income Tax Return.

Processing Time and Refund Information. Please wait at least three days before checking the status of your return on electronically filed returns. PA-1 Special Power of Attorney.

PA-1 Special Power of Attorney. Vermont income tax rates range from 0 to 895 depending on your filing status and how much taxable income you earn. If you file your return by mailing a paper form you should wait four weeks to check the status of your refund.

1st Floor Lobby 133 State Street. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. Since 2014 taxpayers have been able to claim an exclusion of up to.

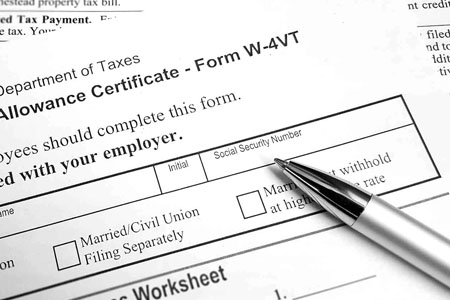

W-4VT Employees Withholding. Lost Refund Check If it has been more than 180 days since the Department issued your refund check contact the Vermont of Taxes for a replacement check. Fact Sheets and Guides.

Vermont income tax rates range from 0 to 895 depending on your filing status and how much taxable income you earn. All Forms and Instructions. Vermont imposes a 6 sales tax statewide.

Processing Time and Refund Information. Click on Check the Status of Your Return Personal Income Tax Return Status. Department of Taxes Check Return or Refund Status No.

Tax season is a bit less painful for many taxpayers this year thanks to larger than average refunds. When you check your return status the state will ask you to enter the exact amount of your expected refund in whole dollars. Last tax season more than 45000 Vermonters claimed the federal and state Earned Income Tax Credit or EITC for a combined average refund of more than 2000.

Cities and municipalities charge local sales tax as well which can be as much as 1 in some areas of the state. Tax refunds are averaging 3226 so. Processing Time and Refund Information.

If you e-file you will usually get your refund in 7 to 10 days. If you file a paper return it usually takes about 3 to 4 weeks to get your refund. If this date falls on a weekend or a holiday returns are due the following business day.

To check the status of your Vermont state refund online follow these steps. Check the status of your Vermont refund using these resources. It should take one to three weeks for your refund check to be processed after your income tax return is recieved.

The Vermont Department of Taxes administers tax laws and collects taxes in the State of Vermont. Vermont State Income Tax Return forms for Tax Year 2021 Jan. Fact Sheets and Guides.

The departments general information number is 1-802-828-2505. This includes all short-term gains but long term-gains may be eligible for an exclusion. It is the same as the IRS deadline for filing federal income tax returns.

Fact Sheets and Guides. All Forms and Instructions. You can find the issue date by calling the taxpayer information line at 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-state.

You will be prompted to enter. Statewide Public Records Database. Vermont State Sales Tax Vermont imposes a 6 sales tax statewide.

IN-111 Vermont Income Tax Return. Processing Time and Refund Information. PA-1 Special Power of Attorney.

Vermont State Sales Tax. B-2 Notice of Change. All Forms and Instructions.

You can also find answers to Vermont tax questions at the states individual income tax site. Fact Sheets and Guides. You can find this by signing in to TurboTax.

Today the State Treasurer Beth Pearce the Internal Revenue Service and other. IN-111 Vermont Income Tax Return. To get your tax refund faster e-file your return.

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate Claim and Estimated Payments. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty. ID type SSNITIN ID number.

Vermont State Tax Refund Vt Tax Brackets Taxact Blog

Vermont Tax Forms And Instructions For 2021 Form In 111

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Personal Income Tax Department Of Taxes

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Your Tax Bill Department Of Taxes

Filing A Vermont Income Tax Return Things To Know Credit Karma

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Individuals Department Of Taxes

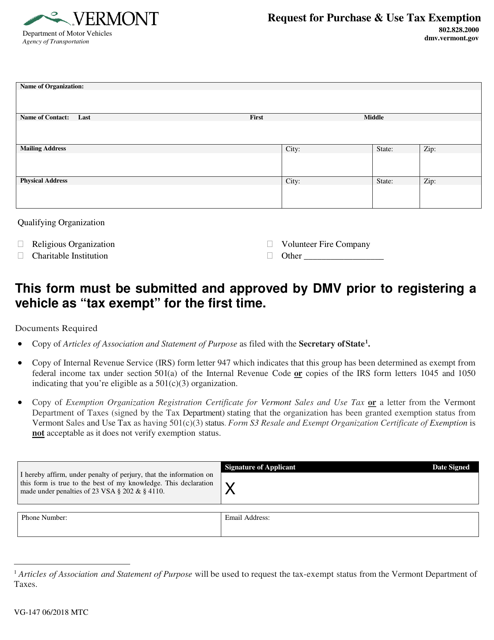

Form Vg 147 Download Fillable Pdf Or Fill Online Request For Purchase Use Tax Exemption Vermont Templateroller

Vermont S Tax System Is Still Unfair Public Assets Institute